Bitcoin

blog.wasabiwallet.io

blog.wasabiwallet.io

zkSNACKs, the developer of Wasabi wallet, has shut down its coinjoin coordinator since June. The news is not surprising, considering that it has already been unavailable for the US customers since May. Since the wallet itself is non-custodial (you hold the keys), and it's using block filters to update your balance directly from the bitcoin network, the wallet functionality is intact. However, if you want to coinjoin, you have to find another public coordinator. A list of currently active coordinators is available on [wabisator.com](https://wabisator.com/), or [wasabist.io](https://wasabist.io/) Coordinators do not require any privileged access to private information, so it should be safe to use any 3rd party coordinator with enough real active users. At no point are your funds at risk of being stolen. However, a dedicated attacker running a public coordinator could still pull a de-anonymization attack by mixing your coins solely with their own outputs.

A great way to help humans in need, and a great example of a use case for bitcoin.

cross-posted from: https://lemm.ee/post/38808464 > Bitcoin is Stupid and Does Not Deserve an Emoji (blog post) > > 35 crypto companies got together to make a change dot org petition called "Bitcoin Deserves an Emoji". > > F that

cross-posted from: https://lemmy.ml/post/17455858 > Had dinner with some boomer-age family friends tonight who shared stories about their grandparents and other relatives who survived (or didn’t survive) the holocaust. > > One family, posing as Christians, managed to escape Poland to the US in 1939. They had to travel through Nazi Germany and Italy on their journey. > > This family invested much of their life savings into expensive camera equipment to not raise suspicion, as they were traveling under the pretense of going on holiday. > > The conversation developed into all the ways people attempted to conceal and travel with wealth as they fled their homeland. Apparently, sewing diamonds into clothing was a common tactic. > > These close friends were struck to hear how Bitcoin enables the storage and transfer of wealth by simply knowing a secret number. I told them of the work @gladstein and others are doing to get Bitcoin knowledge and tools into the hands of political activists and refugees. > > “Fuck You Money” is a world changing technology. Let us not lose site of what really matters here 🫡 🤙 > > From nostr https://njump.me/nevent1qvzqqqqqqypzpz9zcw6zpd9qyacx4xrqp50aw39vdn739cspkaqcn0j77jet82j9qyfhwumn8ghj7mmxve3ksctfdch8qatz9uq3vamnwvaz7tmjv4kxz7fwdehhxarj9ehx2ap0qqsy98wlnfyk6ltxrgptyq6ysxhfwenseqawk08yz493yhdqsmcq4rgc787rs

shop.braiins.com

shop.braiins.com

Ever since the [interview with Lukas Seyfrid (CZ)](https://www.youtube.com/watch?v=TJUeYQy-W1Y), the chief of the hardware team, it was clear that Braiins is pivoting from the development of mining software, to building their own hardware.  This, I believe, is the first iteration of their effort in form of a consumer product, and while it is unlikely to make you a financial return on the investment, it's small form factor and nice anodized aluminum case can allow pretty much anyone to become familiar with the process of bitcoin mining. Or terrorize the testnet. The choice is yours. I think I might buy one, just to try the viability of a pure solar setup. **HW specifications:** ||| | ------------- | ------------- | | Price (pre-order) | $199.00 | | Hashrate | ~1Th/s | | Power Consumption | 40W - 55W | | Number of hashboards | 1 | | Number of ASIC chips | 4 | | Cooling Type | Active | | Noise | 40 dB | | Air outlet temperature | 40-50 °C | **But really, how much would it make in a year?** If we assume the current price and difficulty stays the same, the block subsidy is **3.125 BTC**, median fees around **0.2212 BTC**, free electricity, you'd get **0.001 BTC per 12 months**, which is roughly **65 USD**. A little more than 3 years to break even. It's not going to break any records, but I'm still excited for what's to come next.

trezor.io

trezor.io

It's a successor to the model T, with the new design inspired by the Safe 3, announced earlier this year. They promise nice, easy to use UI, color display, haptic feedback, gorilla glass. Several color variations are available, including the bitcoin-only orange option.

Globally, people are losing faith in our institutions. Our financial institutions, our governments, our media, our medical systems, even democracy as a concept in many cases. And for sound reasons. Proposed upgrades to Bitcoin's protocol would enable use of the chain (and L2s) for things aside from just money. On the world's most secure document: the bitcoin ledger. It will change everything and here's why. **The root problem is that we are building systems which rely on** ***trust*** **and time and time again, that trust has been broken**. We have to *trust* that the people elected or appointed to those positions will do their jobs faithfully. But, of course, like us, they are humans and fallible. Subject to stupidity, greed, misdirection, and error whether through malice or accident. Take money, for example. Money has to be trust-able, so it is entrusted, for all its faults, to the most stable and neutral institutions humanity has ever created: the state. And yet, the state often abuses that authority to print money they shouldn't leading to inflation and hyperinflation, particularly for unpopular wars of conquest. Every failed state ends in hyperinflation, because it's a tool in the state's toolbox and they *will* use it when they have no other options. They'll turn on that money printer if they need to. And time after time, they have. There are ways to create *trustless* systems, where we do not have to trust individual actors to *administer* them faithfully, only for them to be mostly rational actors subject to the same laws of math and physics as the rest of us. Instead, the system administers itself according to some form of protocol. Bitcoin did this for money 15 years ago, it was created by Satoshi in the wake of the nearly total collapse of the global financial system (2008 financial crisis) to create a system which could not suffer the same fate. We all had to bail the banks out because they were "too big to fail", which was true, Bernanke won a nobel prize in economics for his analysis of this and the bailouts likely prevented the worst economic period since the great depression had the entire banking system be allowed to fail. You may not know who Bernenke is, but if you were alive during this time period, you know his face, he was the guy who had to sell the bailouts to the world as an idea. The reality is, fractional reserve banking is a ponzi scheme, and had the banks failed and people realized it, it would have stopped functioning. Our debt-based world order would have collapsed. No credit could be issued to build roads or fund schools or do anything because there would be no money in the banks to use as collateral and nobody would trust it. Just like in the US great depression. You can argue it's a sneakily beautiful ponzi scheme which drives the engine of human progress if you are a die-hard capitalist, but you can't argue it's not a ponzi scheme. **The crazy thing is, Bitcoin worked.** It has kept every promise it made. For 15 years, it has faithfully administered a financial system with a known, transparent, limited supply of 21 million coins which can be transferred across the globe in seconds for pennies in fees. And it has continued to grow no matter which metric you measure it by. Through pandemics, wars, international conflict, attempted bans by major world powers, tick tock, next block, the blockchain continued to function. Not a single hour of downtime, not a single bank holiday, not a single hack or breach of security or protocol. Now, it has a market cap of over 1 trillion USD, which is bigger than the GDP of Israel, the Netherlands, Turkey, or Switzerland, countries with tens of millions of people. It's been consistently over 800 billion for a while now. It moves hundreds of millions of dollars of value on the regular. I can send a transaction to anybody on the planet with a cell phone and halfway reliable internet for under a cent in under a second. Nobody can make Bitcoin print money it's not supposed to print. Nobody can transfer money without the private key of that coin. Nobody can force the network to do anything outside of its protocol, even if they bought every Bitcoin in existence. Even if they had a trillion dollars and 1,000 people with AKs ready to die for it. It's mathematically, computationally, financially, and logistically infeasible. I think **the question is, long-term, how can be we build political and social systems which are equally** ***trustless*** where we don't have to put people in positions of power. Just like democracy did to monarchy in spreading power around and reducing the damage one corrupted individual could do, we can now do that again in an order of magnitude greater in the same direction towards greater democratization. Whether you're a capitalist, a communist, or a member of the federation of planets, this tech has serious promise for making your ideal global vision come true. It's a matter of setting up the system correctly and getting adoption of it. It can be used for voting systems, for the collection of taxes, for the administration of public funds, goods, and markets. It can be used for a lot more than just money. **With smart contract functionality, Bitcoin will be the ledger upon which all this is built.** I'm excited to be here with all of you. **We are early**. Most people I know don't own any crypto. The future is coming. **Thank you Satoshi for your gift to the world.**

I've been using lightning for a couple months now and I've read lots of incorrect or outdated information about it online. It's been a very smooth experience for me, and I want to share what I've learned. **TLDR**: Using lightning with a custodial wallet (strike, cash app, etc) is as easy as using venmo. Transactions happen instantly and cost pennies, often under a single cent. Using it with a non-custodial wallet is *slightly* more complicated but well within the ability of the average person as nearly all the complexity has been abstracted away. Lightning scales really well. # Background: **Lightning is a scaling layer for Bitcoin** that enables you to make transactions off-chain with security being provided by the base chain. Transactions confirm in under a second and the fees measure in pennies. A fundamental problem with blockchain is that space in the blockchain is limited. If you increase the block size (number of transactions per block) or add smart contracts, the size of the chain increases. This means you need more powerful hardware and network connection to run a full node, which increases centralization. Bitcoin, at every turn, has chosen to pursue decentralization, but at the expense of higher chain fees since the limited space increases the competition for the available slots. This is why you can run a Bitcoin node on a 10 year old laptop with a 500GB hard drive but you can't run a node for other cryptos unless you have a server and a fiber connection. Lightning was designed to enable fast off-chain transactions with much lower fees, and it does that. # How to use: To use lightning, you need a wallet which supports it. You can use a custodial or non-custodial wallet. Custodial wallets mean somebody else holds the keys/funds and you trust them to hold onto them. "Not your keys, not your coins" as they say. Custodial wallets are also a popular choice for buying/selling BTC since they can often connect to your bank account. Popular custodial wallets for Bitcoin lightning are Strike, Cash App, and Wallet of Satoshi. I highly suggest strike. **Using a custodial wallet with lightning is as easy as using Venmo.** Non-custodial wallets mean you hold the key. If you don't write down the seed phrase it gives you and the device with your wallet dies, you will lose your key and your funds. Popular non-custodial wallets for lightning are Phoenix (mobile) and Electrum (desktop). Zeus (mobile) is great if you want more control and the ability to receive transactions while the app is closed. Non-custodial wallets can also be slightly more complex to use. I highly suggest Phoenix, I have been using it and it is awesome. Electrum is great as well, but I haven't used it for lightning. Note: an on-chain tx is required to move any of your existing Bitcoin into lightning. Unless you bought your BTC and store it in a custodial wallet or exchange that supports lightning. # Myths: **"Lightning requires you to be constantly re-balancing channels"** * If you use a custodial wallet, you don't even have to know what a channel is, your wallet provider handles all of this. For non-custodial wallets like Phoenix, this is mostly abstracted. * For non-custodial wallets like Phoenix, *most* of this is abstracted away for you. * If you receive a payment and don't have enough liquidity, an on-chain tx will be made which incurs an on-chain fee. Some wallets like Phoenix allow you to rent liquidity for very cheap to avoid these fees. * Most people receive their paycheck and then spend most of it, if you follow this pattern, your channels will stay "balanced". * Some background on channels: in lightning, you make a "channel" by locking up some BTC. If you lock up 1BTC in a channel, you can send up to 1BTC to anybody else. You can have basically an infinite number of transactions in a channel. Every time you send or receive BTC in a lightning channel, the "balance" of the channel is updated ie how much of the BTC in the channel belongs to you vs the other person you opened it with. When you send BTC, you open up "channel capacity" called "inbound liquidity" for somebody to send you BTC over lightning. If you don't have incoming channel capacity and somebody wants to send you BTC, you will need to do an on-chain tx to create it. It works this way to ensure security. **"Funds are easy to steal on lightning and you have to monitor everything"** * Attacks in the wild are incredibly rare because every incentive is aligned against the attacker. * If you use a custodial wallet, you don't have to monitor anything and your funds are safe if you trust your custodian. * If you use a non-custodial wallet, you don't have to worry about this either. Phoenix, for example, automatically uses their watchtower service. As long as your device can connect to the internet every few days, you are fine here. * The main attack watchtowers prevent against (and really the only attack possible in lightning) is for somebody to "force close" your channel and broadcast an "old" channel state on main chain which assigns the wrong amount of BTC to you. If you watch main chain, you can dispute this state they published, get the correct amount of BTC assigned to you, plus a penalty which is charged to the attacker. * Lightning is great for everyday spending. If you have significant funds, on-chain txes and cold storage/multi-sig are best. **"You have to make a channel for everybody you transact with"** False. Once you have a channel with *anybody* you can use that channel to route payments to anybody else on lightning. **"You have to keep manual backups of your channel state or you can lose your funds!"** This is true, but this is usually automated and built into the app. With Phoenix, for example, so long as you have your seed phrase you can install Phoenix on a new phone and automatically retrieve the backups made of your chain state since Phoenix's developers automatically keeps the backups. Other wallets offer similar "storage via lightning" backup options. With custodial wallets, they do this automatically so you just have to remember your username/password. **"Lightning doesn't scale"** * Lightning scales very well. Once you create a channel, you can have essentially an infinite amount of transactions in it, all of which occur off-chain. There is enough chain space to make lightning channels for billions of people. * This provides enough capacity for significant growth in Bitcoin's adoption * A single on-chain tx can make a single channel. There are proposals in the works to make multiple channels with a single tx (channel factories) and other L2s like Ark and Fedimint which extend/complement lightning. **"Sure fees are low now, but as more people use it, fees will get high!"** No. The reason fees increase on main chain is because you have limited space and you must pay miners for that space. A lightning channel, once opened with a single on-chain tx, can host millions or billions of transactions. The cost to route these transactions is extremely small from a computation standpoint, there is no mining required. Space is not limited, so competition for space doesn't drive high fees. **"Lightning is centralized"** Wrong. * Lightning uses the security of Bitcoin's L1 to secure transactions. * Transactions are routed through a network of lightning routing nodes, there's currently [at least 41,000 of them](https://1ml.com/statistics), you can run one on a Raspberry Pi. * Routing nodes can't rug you or steal your funds. You don't have to trust those nodes to secure your BTC, that is secured by L1.

https://www.investopedia.com/news/bitcoin-pizza-day-celebrating-20-million-pizza-order/

Hello everyone! I made a site where you can make bets online with an electrum multisig wallet (p2wsh). I made the UX easy as possible for onboarding and I'd like to hear your feedback about it. The website is currently live on BTC testnet3. I made a cheesy tutorial as well! The site is: https://olivetitan.com You can get testnet coins from https://cryptopump.info, https://bitcoinfaucet.uo1.net/ and many others. I think this is the safest way to bet online currently. BTW you get proof, that you lost :) No one can cheat. I'm also looking into bitVM and exploring how that can help. Still learning! Thank you for reading and hope you have a great time! ♥ NOTE: Do not use LTC, it asks for real LTC, not testnet

www.coindesk.com

www.coindesk.com

"Prosecutors are alleging Samourai Wallet laundered over $100 million in criminal proceeds."

"Recent regulatory action against Consensys and Samourai has instilled fear among other crypto service providers operating in the United States." - Wasabi is the main competitor to Samourai's whirpool mixing service. The only one flying under the radar currently is Joinmarket. - Phoenix is the Lightning network wallet where users keep custody of their funds, but the channel management is outsourced to the company. The only remaining self custodial lightning wallet that remains is Breez. While this news is deeply troubling, it might push further development to more sustainable trustless self-custodial solutions in the long term.

A mini documentary about the mysterious creator of Bitcoin.

cross-posted from: https://lemmy.ml/post/13481220 > How to contact your MEP: https://www.europarl.europa.eu/portal/en/contact > > Source: https://snort.social/nevent1qqsvcedd6dg39eh6633uqqff0p9h2zqyhu3zd6kwyyhzqj7da02x4pszyqe2wpknmwkyd0t295d5ezvtaxr00ngxjtcfuct8pfvyec3snckpwqcyqqqqqqgz2f7lp

Source: https://snort.social/nevent1qqs2lwpm4l9ahzllx2yha4853xknsfxc9yacl653wefkpc0t8crh5dczyrzw4whphc70v4aurp27up0xnh5lqkwt0gzeyfck3wqt39mpe0zwqqcyqqqqqqg8mex40

cross-posted from: https://lemmy.ml/post/13412436 > $500,000 to 14 projects targeting global education, Lightning Network innovation, decentralized communication, and easing access to financial freedom tools for nonprofits > > 🌍🌏🌎🎁 > > https://bitcoinmagazine.com/business/human-rights-foundation-grants-500000-to-14-bitcoin-projects-worldwide > > Grant > #1: USD E-Cash by Dr. Calle, leveraging the Cashu protocol for a secure USD-based Chaumian e-cash system that respects your privacy. Funding will support the full development of this project 🔒💸 > > Grant > #2: BTC Pay Server provides free open source software for organizations that rely on Bitcoin, it is a critical tool for nonprofits operating in challenging environments. Funding will support enhancing the platform's user experience and extend its capabilities 🌐 > > Grant > #3: BOB Space, for its Builders Residency Program in Thailand. Funding will help launch a new cohort, to be dedicated to identifying weak spots in Bitcoin’s decentralization, and making those into strengths 🌱 📡 > > Grant > #4: YiBao, a non-profit that advocates for democracy and human rights within the Chinese-speaking world. Funding will enable translating key Bitcoin educational materials into Chinese and promoting financial freedom inside the world’s biggest Communist country 🇨🇳 > > Grant > #5: The Bitcoin Innovation Hub, led by Noble Nyangoma in Uganda, offers a range of vocational training and financial literacy to women and men, centered around using and earning Bitcoin. Funding will support the addition of classes such as carpentry, baking, and valuable digital skills. > > Grant > #6: Bitcoin Dada, founded by Lorraine Marcel, is on a mission to empower African women with Bitcoin knowledge. Funds will support expansion across Africa, the creation of multilingual educational resources, and promote women-led businesses adopting Bitcoin 💪 > > The grants in this round to both Bitcoin Dada and The Bitcoin Innovation Hub are generously supported by Strike’s nonprofit initiative. Big shout out to Strike and everyone else that makes our work possible! ⚡ > > Grant > #7: The Bitcoin Design Foundation contributes essential user research, aiding Bitcoin wallets and companies in enhancing UX to guarantee Bitcoin's accessibility for all 🎨📲 > > Grant > #8: Bitcoin Optech is a vital resource for the Bitcoin developer community, offering insights into the most important Bitcoin technical conversations. Funds will be allocated towards operational expenses and growth strategies. > > Grant > #9: Damus, the first > #NOSTR client on iOS, is expanding to Android! Funding enables this critical initiative which makes this open source client available to millions of new users in authoritarian countries and the developing world. > > Grant > #10: Bitcoin Core Developer Pablo Martin's contributions help maintain Bitcoin as a secure digital currency, pivotal for activists and individuals in high-risk environments. HRF is proud to support Pablo! 🛡👨💻 > > Grant > #11: LNbits aims to decentralize custodianship and provides users with a robust suite of Bitcoin tools they can run for themselves. Funding will support the core contributors’ salaries, bounties, and educational outreach efforts through workshops and video tutorials ⚡ > > Grant > #12: The Bitcoin Policy Summit 2024, organized by Bitcoin Policy Institute, is a critical platform for discussing how Bitcoin can play a role in protecting human rights. Funding will support event logistics, speaker travel, and attendance by human rights advocates 🏛️🗣️ > > Grant > #13: Video series "Bitcoin for Billions" by > #Bitcoin educator Paco de la India, is making Bitcoin accessible to millions in India, in a variety of local languages. Funding will be used for research, content creation, translation, and promotion 🎥🇮🇳 > > Grant > #14: Scalar School in Brazil, established by Luciana, is nurturing a new wave of Bitcoin and Lightning developers across South America. The grant will go towards teachers’ salaries, training workshops, and university outreach 🌎🇧🇷 > > The Bitcoin Development Fund is committed to facilitating $2 million of grants in 2024, aiming to bolster innovative technical, educational, and community-driven Bitcoin initiatives worldwide > > Submit your application at hrf.org/bdfapply

coinjournal.net

coinjournal.net

> > > The security incident happened on January 17, 2024, Trezor disclosed in a blog post published on January 20. > > > > It involved a third-party support ticketing portal that Trezor uses. > > > > Contact details included names and email addresses for up to 66,000 users were compromised. > >

arstechnica.com

arstechnica.com

A story about Sarah Meiklejohn, and how she started to analyze the blockchain back in 2013. cross-posted from: https://lemmy.zip/post/8623167 > > Once, drug dealers and money launderers saw cryptocurrency as perfectly untraceable.

Luke-jr has always seen Ordinals as a threat to #Bitcoin. He intends to offer a solution that will prevent the creation of new ordinals.

Hi all! Does anybody know if bitcoin core (bitcoin-qt) is also vulnerable to keybleed / randstorm? Thank you

buskill.in

buskill.in

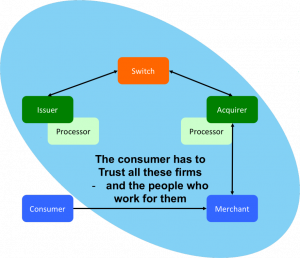

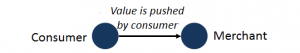

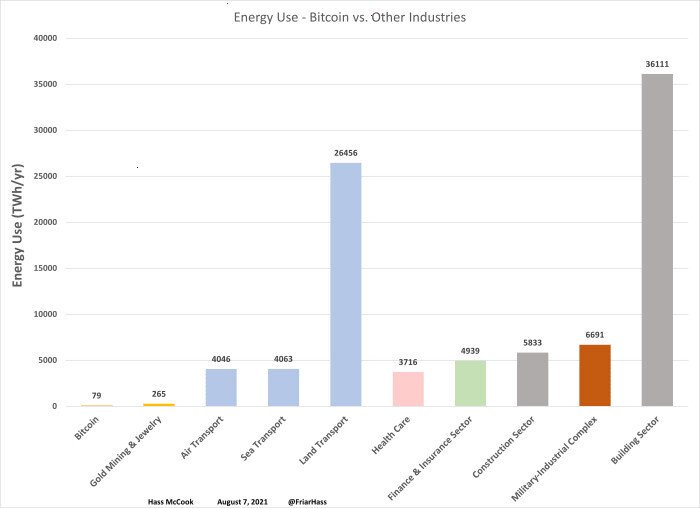

In celebration of **Bitcoin Black Friday 2023**, we're offering a **10% discount** on all [BusKill cables](https://buskill.in/buy/) sold between Nov 18 to Dec 03. | [](https://buskill.in/bitcoin-black-friday-2023) | |:--:| | *BusKill [Bitcoin Black Friday Sale](https://buskill.in/bitcoin-black-friday-2023) - Our Dead Man Switch Magnetic USB Breakaway cables are [10% off](https://buskill.in/buy/) all orders paid with cryptocurrency* | # What is BusKill? BusKill is a laptop kill-cord. It's a USB cable with a magnetic breakaway that you attach to your body and connect to your computer. | [](https://www.buskill.in/#demo) | |:--:| | *Watch the [BusKill Explainer Video](https://www.buskill.in/#demo) for more info [youtube.com/v/qPwyoD_cQR4](https://www.youtube.com/v/qPwyoD_cQR4)* | If the connection between you to your computer is severed, then your device will lock, shutdown, or shred its encryption keys -- thus keeping your encrypted data safe from thieves that steal your device. # What is Bitcoin Black Friday? [Black Friday](https://en.wikipedia.org/wiki/Black_Friday_(shopping)) is ~1 month before Christmas, and it's the busiest shopping day in the US. The first "[Bitcoin Friday](https://web.archive.org/web/20121213223642/http://bitcoinfriday.com/)" ([launched](https://bitcoinmagazine.com/culture/bitcoin-friday-sale-happening-today-1352497394) by Jon Holmquist) was [Nov 9th, 2012](https://www.theregister.com/2012/11/09/bitcoin_friday_sale_event/) (at the time, one bitcoin was ~$11). The following year, the two ideas merged to become [Bitcoin Black Friday](https://www.vice.com/en/article/jp5xxp/bitcoin-is-taking-on-black-friday). This year, we're joining Bitcoin Black Friday by offering our products at a 10% discount if you pay with cryptocurrency. # Why should I use cryptocurrencies? We've always accepted cryptocurrencies because: 1. They're more [secure](https://www.buskill.in/bitcoin-black-friday-2023/#secure) than pre-cryptocurrency payment methods 2. They're a more [egalitarian](https://www.buskill.in/bitcoin-black-friday-2023/#egalitarian) system than pre-cryptocurrency finance 3. They're more [environmentally friendly](https://www.buskill.in/bitcoin-black-friday-2023/#environmentalism) than pre-cryptocurrency financial systems 4. The [fees are less](https://www.buskill.in/bitcoin-black-friday-2023/#fees) than pre-cryptocurrency transactions 5. They allow for [anonymous](https://www.buskill.in/bitcoin-black-friday-2023/#privacy) purchases online 6. Their transactions are [censorship-resistant](https://www.buskill.in/bitcoin-black-friday-2023/#censorship) ## Security Before cryptocurrencies, making an online transaction was horrendously insecure and backwards. | [](https://buskill.in/bitcoin-black-friday-2023) | |:--:| | "Conceptually, pull-based transactions are really not that different than giving three parties the password to your online banking service and trusting them to log in and take what they need. You have to trust the merchant, their IT supplier; the acquiring bank, their third-party processor; the card network; and your own card issuer---and everybody who works for them and has access to their systems. If a bad guy gets hold of your card details at any point in this process, they could drain your account. | | The picture shows the scope of all the entities with access to your critical card information" [source](https://www.coincenter.org/education/crypto-regulation-faq/how-are-payments-with-bitcoin-different-than-credit-cards/) | [Asymmetric cryptography](https://en.wikipedia.org/wiki/Public-key_cryptography#History) has been available since the 1970s, but [CNP (Card Not Present)](https://en.wikipedia.org/wiki/Card_not_present_transaction%22) transactions to this day still don't use public keys to sign transactions. Rather, you give your private keys (that is, your credit card number, expiry, etc) directly to the merchant and you authorize them to **pull money out of your account** (trusting that they take the right amount and not to loose those precious credentials). Bitcoin flipped this around to actually make transactions secure. **With bitcoin**, you don't give others the keys to take money out of your account. Instead, **transactions are push-based**. You sign a transaction with your private keys, and those keys are shared with no-one. Even today, pre-cryptocurrency transactions are abhorrently insecure. In the US or Europe, if someone knows your account number and bank, they can [direct debit money out of your account](https://www.telegraph.co.uk/news/uknews/1574781/Jeremy-Clarkson-eats-his-words-over-ID-theft.html). For the same reason, losses due to credit card theft is enormous. To quote Satoshi Nakamoto's criticism of pre-cryptocurrency transactions, "A certain percentage of fraud is accepted as unavoidable" In fact, fraudulent transactions in the banking industry are so common that your bank will generally reimburse your account for any malicious transactions that you tell them about within 60-90 days. But if someone drains your account of all your money and you don't notice for 12 months? Too bad. All your money is gone. | [](https://buskill.in/bitcoin-black-friday-2023) | |:--:| | In Bitcoin, transactions are push-based. [source](https://www.coincenter.org/education/crypto-regulation-faq/how-are-payments-with-bitcoin-different-than-credit-cards/) | [Tokenization](https://en.wikipedia.org/wiki/Tokenization_(data_security)) and [3DS](https://en.wikipedia.org/wiki/3-D_Secure) are merely bandages on a fundamentally backwards, pull-based transaction model. But because [bitcoin is push-based](https://www.coincenter.org/education/crypto-regulation-faq/how-are-payments-with-bitcoin-different-than-credit-cards/), it's magnitudes more secure. ## Egalitarian If you have a bank account, then you probably take a lot of things for granted. Like buying things online (with a credit card). Or getting cash when traveling abroad (from an ATM machine). Or taking out a loan so you can start a business. Before crypto-currencies, it was very difficult to do these things unless you had a bank account. And in 2008 (the year with the first-ever bitcoin transaction), McKinsey & Company published a report concluding that [half of the world's adult population is unbanked](https://www.mckinsey.com/~/media/mckinsey/industries/public%20and%20social%20sector/our%20insights/half%20the%20world%20is%20unbanked/half-the-world-is-unbanked.pdf). But with crypto-currencies, anyone with access to the internet and a computer or smart phone can use bitcoin to send and receive money online -- without needing to first obtain a bank account. ## Environmentalism The energy required to facilitate transactions in decentralized, blockchain-based cryptocurrencies like bitcoin is minuscule by comparison. And, most importantly, the amount of energy used to solve the proof-of-work problem does not grow as the number of transactions-per-second grows. Traditional financial institutions require an enormous amount of overhead to facilitate transactions in their centralized networks. Unlike bitcoin, which was designed specifically to [eliminate the unnecessary overhead](https://www.buskill.in/bitcoin-black-friday-2023/#fees) created by a trusted third party, pre-cryptocurrency transactions required humans to verify transactions. These humans require office buildings. These office buildings require energy to build and maintain. And, most importantly, as the number of transactions-per-second grows on their network, the number of humans and office space also grows. | [](https://buskill.in/bitcoin-black-friday-2023/) | |:--:| | Bitcoin versus other industries --- yearly energy use, in TWh [source](https://bitcoinmagazine.com/business/bitcoin-energy-use-compare-industry) | This fact is often misunderstood because there's a lot of misinformation on the Internet that makes a few disingenuous modifications to the facts: 1. They calculate the energy usage of the computers processing transactions only, maliciously omitting calculating the energy usage of the entire industry's infrastructure (eg energy used by office buildings) 2. They calculate the energy usage *per transaction*, maliciously omitting the fact that the amount of energy expended by bitcoin miners is automatically adjusted by the proof-of-work algorithm (so energy usage does not increase as the network scales-up) 3. They offer statistics about "energy usage" without mentioning the energy sources. It matters if the energy source is coal/nuclear/natural-gas or solar/wind/hydroelectric > | "...estimates for what percentage of Bitcoin mining uses renewable energy vary widely. In December 2019, one report suggested that 73% of Bitcoin's energy consumption was carbon neutral, largely due to the abundance of hydro power in major mining hubs such as Southwest China and Scandinavia. On the other hand, the CCAF estimated in September 2020 that the figure is closer to 39%. But even if the lower number is correct, that's still **almost twice as much [renewable energy sources] as the U.S. grid**" | [](https://buskill.in/bitcoin-black-friday-2023/) | > |:--:|:--:| > | [source: Harvard Business Review](https://hbr.org/2021/05/how-much-energy-does-bitcoin-actually-consume) | Nic Carter | The facts are that the energy usage of bitcoin is magnitudes less than the energy used by pre-cryptocurrency financial intuitions, that energy usage does not increase as the number of transactions processed by the network increases, and that mining bitcoin is often done with renewable energy. The facts are that the energy usage of bitcoin is magnitudes less than the energy used by pre-cryptocurrency financial intuitions, that energy usage does not increase as the number of transactions processed by the network increases, and that mining bitcoin is often done with renewable energy. ## Low Fees The introduction to the [Bitcoin White Paper](https://bitcoin.org/bitcoin.pdf) (2008) clearly states that Bitcoin was created to reduce costs by using a distributed ledger (the blockchain) to eliminate the need for a trusted third party. > | "Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model. | | > |:---|:---| > | Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes. **The cost of mediation increases transaction costs**... | | > | These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party. | | > | What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party. Transactions that are computationally impractical to reverse would protect sellers from fraud, and routine escrow mechanisms could easily be implemented to protect buyers. In this paper, we propose a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions." | [](https://buskill.in/bitcoin-black-friday-2023/) | > | [source: Bitcoin Whitepaper](https://bitcoin.org/bitcoin.pdf) | Satoshi Nakamoto | At the time of writing, **the [average transaction fee](https://bitcoinfees.net/) for a bitcoin transaction is $0.06**. And unlike pre-cryptocurrency transactions, you can increase or decrease the fee that you pay to increase or decrease the time it takes for the transaction to complete (at $0.06, it will get added to the blockchain in **~1 hour**). By comparison, the way to send funds internationally through the Internet via pre-cryptocurrency banks is via an **[international wire transfer](https://en.wikipedia.org/wiki/Wire_transfer)**. Fees very per bank, but [they typically charge **$15-$85 per transaction**](https://www.nerdwallet.com/article/banking/wire-transfers-what-banks-charge). And unlike bitcoin, wire transfers won't make move on nights and weekends, so they can take **1-7 days** to complete. Also, with bitcoin, that $0.06 transaction fee only applies when you're sending money. Many banks will *also* charge a fee for an incoming wire transfer. In bitcoin, there is no transaction fee to receive money. ## Anonymity Though early cryptocurrencies like Bitcoin don't ensure anonymity like newer privacy coins, [ZCash](https://en.wikipedia.org/wiki/Zcash) and [Monero](https://en.wikipedia.org/wiki/Monero) were designed specifically to provide private transactions. This allows our customers to purchase from us anonymously, which can be extremely important for activists and journalists whose lives are threatened by their adversaries. | [](https://twitter.com/wikileaks/status/80774521350668288) | |:--:| | WikiLeaks started accepting donations in Bitcoin 7 months after PayPal froze their account | We accept both ZCash and Monero. If you'd like us to accept another privacy coin, please [contact us](https://buskill.in/contact) :) ## Censorship-Resistant Cryptocurrencies like bitcoin are peer-to-peer and permissionless. Transactions exchanging bitcoins occur directly between two parties. There is **no middle-man** that has the power to block, freeze, or reverse transactions. Before blockchains were used to maintain a public ledger and enable peer-to-peer transactions, we were dependent on big financial institutions to move money on our behalf through the internet. That antiquated system allowed them to censor transactions, such as donations made to media outlets reporting war crimes and donations to protest movements. > | "For me, that is one of the coolest things about bitcoin... | | > |:---|:---| > | People can potentially use it donate more anonymously to dissident groups and causes in a world where mass government surveillance threatens freedom of expression and certainly harms activists' ability to fundraise for their work, when people are afraid they could be targeted by a government for donating to a worthy cause." | [](https://buskill.in/bitcoin-black-friday-2023/) | > | [source](https://www.vice.com/en/article/jp5xxp/bitcoin-is-taking-on-black-friday) | Evan Greer | After [PayPal froze WikiLeaks's donation account](https://wikileaks.org/PayPal-freezes-WikiLeaks-donations.html) in 2010, WikiLeaks started [accepting bicoin](https://www.forbes.com/sites/forbesdigitalcovers/2018/07/30/the-backsies-billionaire-texan-builds-second-fortune-from-wreckage-of-real-estate-empire-hed-sold/?sh=6f75c6883a72) in 2011. From [Occupy Wall Street](https://web.archive.org/web/20111126164538/http://occupywallst.org/donate/) to [Ukraine](https://www.washingtonpost.com/world/2022/03/03/donate-ukraine-money-crypto/), defenders of democracy have utilized permissionless cryptocurrencies to accept international donations without the risk of transactions made through financial institutions. ## Buy BusKill with crypto Don't risk loosing your crypto to a thief that steals your laptop. Get your own [BusKill Cable](https://buskill.in/buy/) at a 10% discount today! **[Buy a BusKill Cable](https://buskill.in/buy)** [https://buskill.in/buy](https://buskill.in/buy) You can also buy a BusKill cable with bitcoin, monero, and other altcoins from our [BusKill Store's .onion site](http://buskillvampfih2iucxhit3qp36i2zzql3u6pmkeafvlxs3tlmot5yad.onion/buy/). ` ` [](https://buskill.in/buy) [](https://buskill.in/buy) ` ` ` ` Stay safe, The BusKill Team https://www.buskill.in/ http://www.buskillvampfih2iucxhit3qp36i2zzql3u6pmkeafvlxs3tlmot5yad.onion

www.nobsbitcoin.com

www.nobsbitcoin.com

A new type of vulnerability has been found, affecting the routing nodes, allowing the attacker to steal the amount locked in HTLC you're forwarding for them. Several scenarios and possible mitigations are suggested in the article. For more details, see the original paper: https://github.com/ariard/mempool-research/blob/2023-10-replacement-paper/replacement-cycling.pdf Discussion on stacker.news: https://stacker.news/items/288995

trezor.io

trezor.io

There's a new Trezor HW wallet available. It's a long awaited refresh of the original Trezor One. Two buttons, one screen, USB-C, and a new chip that makes it tick. Now with 100% more secure element! They also offer a new cold storage solution - https://trezor.io/trezor-keep-metal . The form factor is similar to cryptosteel, but the mechanism of entering the seed phrase is different. You punch a bunch of holes in the metal plates. Depending on what material is used, I'd say it's much more fool proof compared to cryptosteel. If an unsuspecting nocoiner opens it, there is no risk of them just spilling all the letters out and financially ruining the whole family in the process.

I'm sick of coming here and not having somewhere to talk so here's a thread for everyone. I like Bitcoin, and u?

He has invested many years ago, he doesn't remember how much and he has never been able to figure it out himself so now im trying to help him on the first page it says "bitcoin" his mail and then some letters and numbers in a string, and then some random notes and a few shopping lists, but on many pages is the exact same shopping list consisting of 7 items so i think that might be the code but idk i have not yet found anthing that could be the code can anyone help me getting his bitcoins back

Is there any online service/tool/website which provides a way to show badges (little SVG images like are commonly seen in Github readmes) which show the balance of a BTC address? Bonus if it shows the USD value as well. I found a project on github called balancebadge but seems to be dead. This is so we can show the current total amount of donations made to an open-source project. Example of badges I’m talking about:

Bitcoin

!bitcoin@lemmy.world- Do not use URL shortening services: always submit the real link.

- Begging/asking for bitcoins is absolutely not allowed, no matter how badly you need the bitcoins. Only requests for donations to large, recognized charities are allowed, and only if there is good reason to believe that the person accepting bitcoins on behalf of the charity is trustworthy.

- News articles that do not contain the word "Bitcoin" are usually off-topic. This sublemmy is not about general financial news.

- Submissions that are mostly about some other cryptocurrency belong elsewhere. This sublemmy is exclusive to Bitcoin.

- No referral links in submissions.

- No Self Promotion